indiana excise tax alcohol

Indiana Alcoholic Beverage Permit Numbers List the Indiana Alcoholic Beverage Permit Numbers obtained from the Indiana Alcohol and Tobacco Commission. Multiply Line 5 by the tax rate in each column.

U S Alcohol Tax And Fet Reform Overproof

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1.

. Avalara solutions can help you determine excise tax and sales tax with greater accuracy. 2015 indiana code title 71. But if the wine has.

The Indiana Department of Revenue DOR provides the food and beverage tax rates for each county or municipality in the table below. The Indiana Alcohol and Tobacco Commission ATC is happy to provide guidance and direction on the process for submitting applications and. For more information about the technical.

Indianas general sales tax of 7 also applies to the purchase of liquor. Indiana state taxes on hard. Indianas excise tax on Spirits is ranked 42 out of the 50 states.

A tax rate of 1334 per proof. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. This 42 million tax hike alone would cause the price of distilled spirits to rise by 7 and would.

State Excise police officers are empowered by statute to enforce the. Indiana Alcoholic Beverage Permit Numbers Section B. For more information about Alcohol excise taxes contact DORs Special Tax Division at excisetaxdoringov or 317-615-2710.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. And for wine the pay an extra 47 cents. A tax rate of 270 per proof gallon on the first 100000 proof gallons in production.

Gross Alcohol Tax Due. The alcoholic beverage excise tax is imposed on all alcoholic beverages at a per-gallon rate paid by Brewers Wholesalers and Permittees in Indiana. The Indiana State Excise Police is the law enforcement division of the Indiana Alcohol and Tobacco Commission.

2016 indiana code title 71. Liquor excise tax download as pdf. In Indiana liquor vendors are responsible for paying a state excise tax of 268 per.

Attend a certified server training program in my area. The Indiana excise tax on liquor is 268 per gallon one of the lowest liquor taxes in the country. An excise tax at the rate of two dollars and sixty-eight cents 268 a gallon is imposed upon the sale.

Revenue and taxes chapter 3. The per-gallon rates are as follows. House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100.

Liquor excise tax download as pdf. Alcohol and tobacco article 4. As of January 1 2020 the current federal alcohol excise tax rates are.

Add Line 6 amounts from all columns. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. You may also contact your county auditors office to.

Indiana Alcoholic Beverage Permit Numbers Indicate the Indiana Alcoholic Beverage Permit Numbers obtained from the Indiana Alcohol and Tobacco Commission. Alcohol and tobacco article 4. Revenue and taxes chapter 3.

Collection Allowance for Timely Payment. The primary excise taxes on tobacco in Indiana are on cigarettes though many states also have taxes on other tobacco products like cigars snuff or e-cigarettesThe tax on cigarettes is. Alcohol Beverage Applications Forms.

Indiana Liquor Tax - 268 gallon. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Have a State Excise Officer speak at my school or organization.

Apply for employment as an Indiana State Excise Police officer. For beer they pay an extra 11 and one-half cents.

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Indiana Dor Nears Completion Of Multi Year Tax System Modernization Wbiw

Alcohol Taxes On Beer Wine Spirits Federal State

Historical Indiana Tax Policy Information Ballotpedia

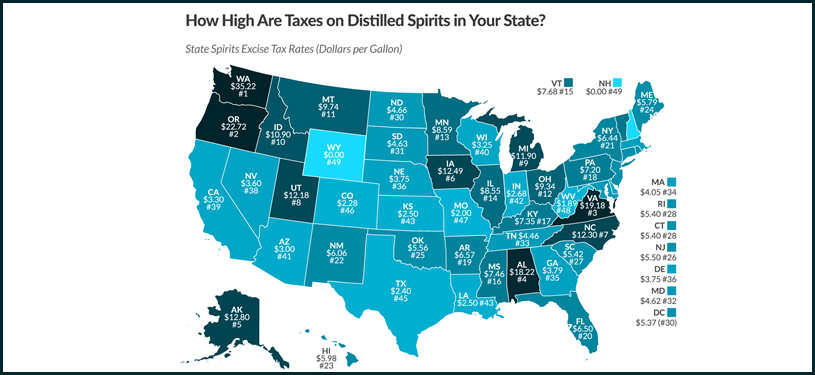

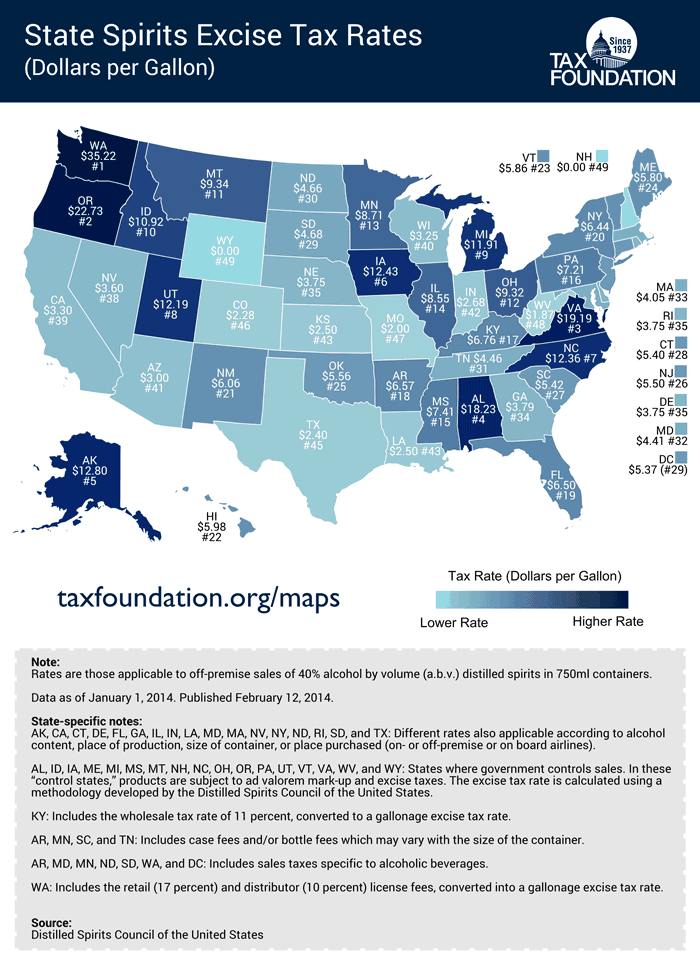

How High Are Spirits Taxes In Your State Tax Foundation

Liquor Taxes How High Are Distilled Spirits Taxes In Your State

Half Of The Price Of Your Whiskey Could Be Tax The Whiskey Wash

Alcohol Taxes Make Illinois Independence Day Celebrations Costlier

Liquor Gallonage Tax Excise Utilities Taxes

By The Numbers North Carolina Ranks 6th Highest On Alcohol Taxes North Carolina Thecentersquare Com

Indiana Liquor Control Information Alcoholic Beverage Commission Laws

Opposition Building Against Raising Excise Taxes On Liquor Beer And Wine Illinois Thecentersquare Com

State Liquor Tax Rates Are Stuck In The Mud Tax Policy Center

Alcohol Taxes On Beer Wine Spirits Federal State

Last Call New York Bill Would Double State Excise Tax Indiana Cold Beer Sales Effort To Resume Brewbound

New Vermont Law Lowers Tax On Ready To Drink Cocktails Expands Sales Vermont Thecentersquare Com

Vintage Old Quaker Rye Whiskey Bottle With Label And Indiana Excise Tax Stamp Ebay